This is a unique program your credit card company doesn't want you to use. Minimum fees and much interest can be erased with the process from this helpline. The company cancels out interest rates, utilizes their track-record, and negotiates with credit cards companies.

Credit card debt burdens many American families. In fact, 41% of all households carry this debt.1

Currently, a debt relief program number is open to more enrollments. If you have trouble getting through, please try waiting up to 2 minutes in case the line is busy. If you continue to have problems, contact us so we can make sure the program is open to new applicants. Call the number to see if you qualify instantly (or if you have questions).

Here is the truth as to why this helpline can lower your debt.

First, the debt relief program consolidates all owed debt into a single monthly payment. This works because credit card interest rates are incredibly high. In fact, for fair credit, they average 23.43% and penalty APR is even higher!2 But, with the program, interest rates can drop significantly.

Most importantly, the biggest savings come by having the debt relief program negotiate away fees, penalties, and much of the total debt.

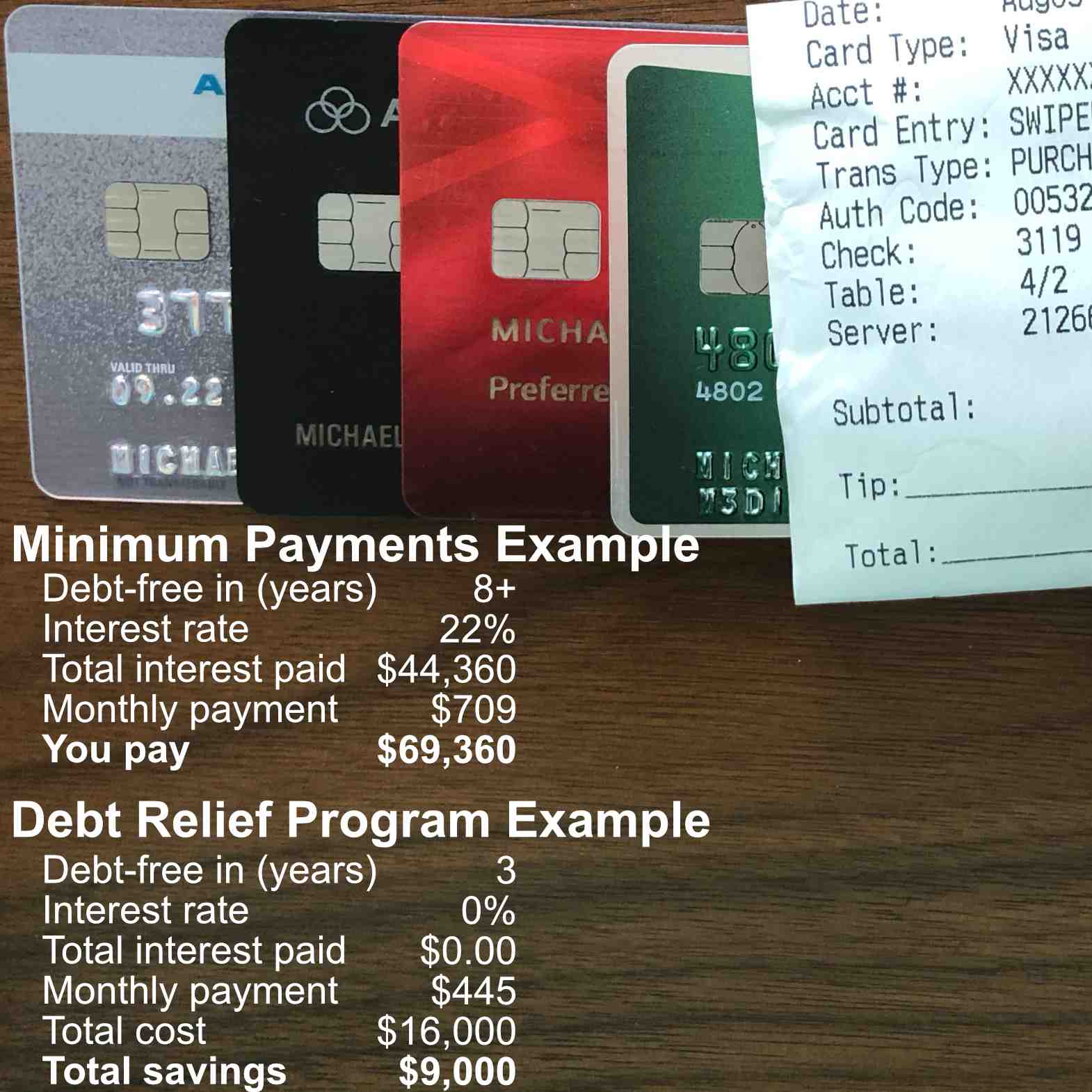

Here's an illustrative example with paying minimum payments vs. using this program:

What you can do. If you or a loved one is struggling with debt, it's hard to get out of it. Credit card companies don't make it easy. 41% of Americans wouldn't have this debt, if it was easy.

You must have over $10k in credit card debt to qualify. In two steps, get matched with a helpline.